The credit card has come a long way since it first emerged in 1950 thanks to Diners Club. Today they are a multi-billion industry. Credit cards are very good to use at online casinos. They are among the 5 most popular payment methods at the top UK casinos. The ones that are most commonly used are the Visa and MasterCard credit cards.

The credit card has come a long way since it first emerged in 1950 thanks to Diners Club. Today they are a multi-billion industry. Credit cards are very good to use at online casinos. They are among the 5 most popular payment methods at the top UK casinos. The ones that are most commonly used are the Visa and MasterCard credit cards.

We have put together for you a list of the top UK online casinos that accept Visa and MasterCard credit cards for making payments. All these casinos have been tested by our team for different aspects related to deposits and withdrawals, besides the regular parameters that we test them for.

Read our reviews of these casinos; then click on the one that you think is right for you, to start playing.

Best UK Visa and Mastercard Credit Cards Casinos

| 1 |  |

£100 (18+ T&C; apply) |

Get Bonus | ||

| 2 |  |

Visit Bet365 (18+ T&C; apply) |

Get Bonus | ||

| 3 |  |

£1,000 (18+ T&C; apply) |

Get Bonus |

Why Visa and MasterCard Credit Cards are Popular at the Top UK Online Casinos

There are quite a few reasons for the popularity of Visa and MasterCard credit cards at the top UK online casinos.

- These are international brands that are accepted at almost every outlet with an electronic transfer facility worldwide.

- The brand value ensures complete safety and security. They use high levels of encryption and other advanced technology to secure your payments and deposits.

- Deposits made using a Visa or MasterCard are instant.

- A number of the top UK online casinos also allow withdrawals using a Visa credit card.

- You get to use money on credit, which means you can play even if you don’t have money in your bank account at that point in time.

- Payments are fast and instant, especially deposits into your casino account.

There are disadvantages too, when you use a Visa or MasterCard credit card to play at your favorite UK online casino.

- Since this is not money that is going from your bank account at the time of playing, you may tend to overspend.

- Another inherent danger is the possibility of reaching or crossing the maximum credit limit allowed on your card.

- This could directly impact your credit history, and that has a huge say in any future credit based transactions you may be looking to do.

- From a gambling point of view, a big risk is the possibility of addiction to gambling.

Registering for a Visa or MasterCard Credit Card Account

To use a Visa or MasterCard credit card to deposit funds into your account at one of the top UK online casinos you must first have an account with the card provider itself.

- Get the form from Visa or MasterCard and fill it up with the required details.

- All details have to be accurate and representative of you.

- The credit card company verifies the information provided on the form.

- Among items verified include your credit history.

- You are issued a credit card once the final report of the verification process is positive.

- The amount of credit you are entitled to depends on your salary, credit history, and other factors.

- There is no sign up fee involved most of the time. There could, however, be a maintenance fee charged annually.

- Other fees involved include transaction fees at times; depending on nature and value of transaction.

Using a Visa or MasterCard Credit Card at the Top UK Online Casinos

Once you have a Visa or MasterCard credit card you can use it to deposit funds into your casino account.

Once you have a Visa or MasterCard credit card you can use it to deposit funds into your casino account.

Ensure that you have not maxed out the credit limit on your Visa or MasterCard credit card; otherwise you will not be able to use it.

- Open an account with one of the top UK online casinos on our list that accept Visa and MasterCard credit cards.

- Register your Visa or MasterCard credit card with the casino while opening your account.

- Enter your name and other details on the registration form available online; it should be spelled the same way as in your credit card to avoid complications while using it later.

- Enter card details like the card number, CVV number, billing address, expiry date, and other details.

The card is now registered with the casino. To use it to deposit funds, follow the steps listed below.

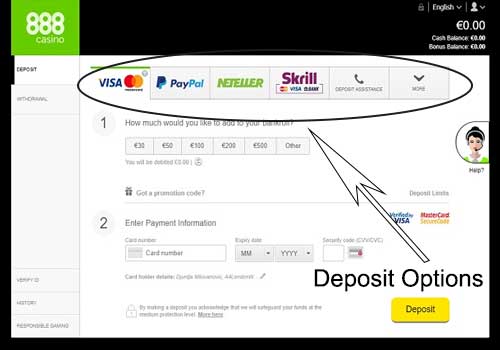

- Go to the Banking or Cashier segment of the casino’s website.

- Click the Visa or MasterCard credit card logo. This gets it selected as the payment method.

- A fresh screen appears. Enter the amount you want to deposit into your casino account.

- Enter the CVV number that is present at the backside of your credit card. This is a validation exercise.

- Confirm the details you have entered and click the OK button.

The funds get transferred from your Visa or MasterCard credit card account to your casino account almost instantly.

Some casinos allow you to use your Visa credit card to withdraw funds from your casino account. The process is almost the same.

- Go to the Banking or Cashier section.

- Select the Visa or MasterCard logo as the withdrawal option from the list provided.

- On the new screen that appears enter the amount you want to withdraw.

- Enter any other relevant details the casino asks for.

- You may have to fill a verification form as well.

- Confirm the details and click the OK button.

The casino then takes a little time to verify and process the withdrawal. Once it is processed the money reaches your credit card account in a maximum of 24 hours.

Alternative Payment Methods to Visa and MasterCard Credit Cards

In the broad range of payment methods available globally, it is quite clear that one size doesn’t fit all and payment behaviours and preferences depend largely on regional cultural nuances. Consumers are no longer bound by traditional credit-based or classic payment options although it is safe to say no one expected the world to change so quickly and as much. Payment methods constantly innovate to respect the needs of both their future and current clients since the younger generation’s buying power increases as they grow up and once a payment preference is formed it is difficult to change.

Retail giants such as PayPal and Alipay previously owned the eWallet market, but more recently network and bank wallets have emerged, and Visa Checkout is amongst the forerunners. There are also others that have entered the market, and Skrill and NETeller are major players in the online payment services sector, driven by the need to attract clients by integrating technology that would add to users lifestyles.

The consumer choice in alternative payment methods has never been this broad, and while many individuals may guess that the variety of payment options are a result of revenue generating strategies used by major players it is more about adding value that enriches consumers online shopping experiences.

Users pay an annual charge on credit cards such as Visa and MasterCard and draw on a credit limit that has been approved by the card-issuing bank. The credit balances are rolling, and part of the balance outstanding need to be paid with interest on a month-to-month basis until the balance is settled in full. MasterCard and Visa also offer pre-paid cards that can be used to make purchases while the key difference is that users are not required to provide their credit card details to online casinos or other merchants.

Consumers are clear on their needs and faced with more choices than ever before the winners of the eWallet battle are required to offer exceptional services. Services in demand consist of continuity of convenience, payment options used internationally, assured security and privacy plus personalization and loyalty rewards, particularly as it is predicted that ewallets will overtake credit card use by latest 2019.

Pre-paid vouchers flourish in an economy that was previously credit-driven since consumers select now to be more in control over their spending habits. Pre-paid payment methods are preferred, and for this reason, the golden age of credit is something that belongs in the credit-centric past. Consumers no longer want the burden of debt, are hyper-aware of damaging their credit records, and UK residents prefer to fund their online casino accounts with available funds instead of credit that needs to be paid back, which makes winning at any UK licensed casino just so much more rewarding.

Online casinos offer the fastest payouts to online players using ewallets, and by using this payment method to fund online casino accounts, players qualify for excellent bonuses, as well as generous loyalty rewards.